Pedro's blog

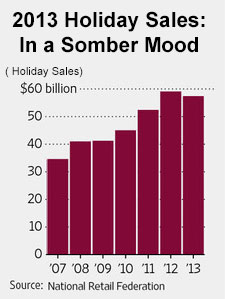

2013 Christmas: Holiday sales may sink despite big offers

With the Federal Reserve planning to buy $600 billion of debt owned by Freddie Mac and Fannie Mae, mortgage rates have plunged to the lowest in the past 7 years. Average rates on 30 year fixed mortgages with no fees and closing costs have gone down to around 5.25%.

Earlier when rates have been going high, home resales have hung up. However, the Fed's move to purchase Freddie Mac and Fannie Mae loans is expected to bring some positive changes in the housing market.

Jumbo Mortgage rates down but lending rules gets tighter

As a part of the Economic Stimulus Bill, jumbo mortgage limit has been extended especially in higher cost areas. And recently rates on jumbo loans have also dropped down. But in spite of this, borrowers aren’t able to make use of the rate cut or the extended limit. This is because even though rates have gone down, lenders have tightened their lending criteria.

I find a lot of websites offering mortgage quotes online itself. What I mean is, not simply applying for quotes online but applying as well as getting the quotes online. Whether it is preferable or not, is quite controversial. Some say it's fast and easy, and you don't have to take out time to visit the lender's office or call up to discuss your financial situation and do some analysis before getting the loan. While others like me feel the best is to have a talk with the lender/broker.

Are you in a situation where the lender has declared foreclosure and you don’t know what the next step is for you? Well, there are workout options such as an alternative repayment plan, loan modification, or a partial claim to try out for. But such things are ok only if you wish to preserve the home.

What if you wish to move out? Well, you’d probably negotiate for a short sale if you’re upside down on the mortgage. Or perhaps you may try to negotiate for a deed-in-lieu because this is one option where you need not pay the deficiency as the law says.

Hi,

The finance sector is where things change fast and everyday we come across some new changes being implemented.

So, while you enjoy the weekend, take a sneak peak into the top 4 finance news/stories shared on the web.

Hi all,

An exciting experience that I feel like sharing with you - it's about a presentation I've just completed. It's on Reverse Mortgages - we all know it helps seniors but aren't there other options doing the same for them?

There are, but which is better - reverse mortgage or the plethora of options such as the Medicaid, Medicare, equity loans, social security and the like? It's a big question no doubt and I've tried to find out the right answer to it!