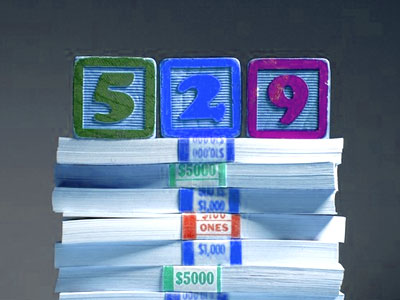

It makes great sense to develop a saving strategy for college education for your children. Higher education in the country is costly but undoubtedly it augments the chance of getting a better job. Data published by the Department of Education's National Center for Education Statistics reveals that a candidate with a bachelor's degree, on an average, is likely to earn 38% more than someone who does not have a degree. Here lies the importance of 529 plans. These are federal efforts for the promotion of higher education by making college education within the affordable limits. This plan was created in 1996 and is named after the Section 529 of the Internal Revenue Code. All the states in the country offer at least one 529 plan. There are two categories of 529 plans – prepaid plan and savings plan.

Prepaid plan

Here college fees are prepaid at today's prices for a candidate who is likely to attend college in future.

Savings plan

Here contributions are made now to pay the future college expenses. This has similarity with the 401(k) retirement saving plan.

Benefits of a 529 plan

There are several benefits of a 529 plan. Some important benefits are listed below.

- There are several tax benefits associated with this plan. Here your earnings grow tax-free for qualified education expenses. In addition to the federal tax benefits, you also receive some tax benefits offered by your state. Tax benefits offered by the state government may include exemption of income on withdrawals or upfront deduction for the contributions that you make.

- Here the person who actually makes contributions has the complete control over the fund. The actual beneficiary of the funds is not in a position to garner control over the fund.

- It does not require high maintenance costs. If you have fixed your mind to opt for a 529 plan, you have to just fill up a very simple enrollment form and start making contributions. To make it easier, you can set up an automatic transfer system.

- Unless and until you make withdrawals from the 529 account, you are not likely to receive Form 1099 from the tax authority.

- Here you have the liberty to choose your college. It may not be necessarily in the state from where you took the plan. In other words, your choice of school is not limited by the state from where your 529 plan has been generated.

Limitations of a 529 plan

Despite its several benefits, a 529 plan is also fraught with some limitations. Some of these limitations are briefly described below.

- If 529 plan is treated as an investment plan, then it has to be accepted that here you have very limited choices for investment. Here you don't have the liberty to choose your investment portfolio on your own.

- The 529 proceeds should be used for qualified expenses. If that proceeds are used for the qualified expenses, then you will have to pay income taxes on that amount. Moreover, penalty may also be imposed on you.