While taking out a home loan, there are many factors and events you will have to keep in mind!

As a consumer, you got to be wise and see what loan terms and interest rates are suitable for you. I guess you very well know, there are two types of interest rates offered on mortgages; one is the Adjustable Rate Mortgage (ARM) or variable rate mortgage, and the other is the Fixed Rate Mortgage(FRM).

How do the interest rates look like in ARM and FRM?

In the ARM, the interest rates change or vary according to the current market status. The interest rates are adjusted depending on a reference index.

The banks and mortgage lenders use a certain reference index that can either be the common reference indexes or an index specially designed by the bank for its own purposes, based on their unique revenue and financial reports.

The most common and reliable reference indexes currently used by the majority of lenders include:

- FHFA Monthly Interest Rate Survey (MIRS)

- 12-month Treasury Average Index (MTA)

- Constant Maturity Treasury (CMT)

- LIBOR- London Interbank Offer Rate

- 11th District Cost Of Funds Index (COFI)

- National Average Contract Mortgage Rate Bill Swap Rate (BBSW)

Not only this, there’s one parameter that determines how much an interest rate can rise or fall. It’s the margin or the ‘fixed-constant’ of an interest rate on an ARM.

An example might help you to understand this aspect.

If an ARM has a constant margin of 5%, then if the index, followed by the lender, rises or falls by 2%, the overall Annual Percentage Rate (APR) of the loan will be either 3% or 7%.

What is an Annual Percentage Rate?

The APR is what you can call a summation. When you see the hoardings and advertisements that a loan is carrying an interest rate of 4.5% or 4.7%, it’s just the basic margin or the constant rate on a loan. But that’s not APR.

APR is calculated after considering closing costs, processing fees, down payments, buying discount points, and so and so. Hence the loan that comes with a margin rate of 5%, the APR for it can be somewhere around 7%.

This APR is highly unpredictable when it comes to ARM home loans.

For Fixed Rate Mortgages, a one time APR is calculated that remains fixed and unchanged throughout the loan term.

How to calculate the present value of an ARM and FRM:

Till now, you have a good idea that it is APR which equates to be the final resulting interest rate on a mortgage.

So for a fixed rate mortgage, you have a stable APR, and you use that to see what your EMIs will be each month. Pretty easy to calculate and easy to understand the present value of a loan on FRM.

But why should you calculate the Present Value of a mortgage in the first place? Because a present value will help you to understand whether an FRM or an ARM is right for you, and will help you to predict the future inflation or deflation of the mortgage loan.

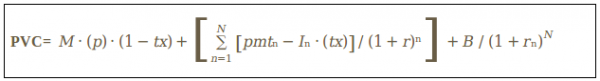

The basic formula for calculating the Present Value of home loan is based on Monte Carlo technique. The equation was devised in @RISK Simulation software.

Where PVC= Present Value Cost of Mortgage

- M = The mortgage amount

- p = The discount points rate

- tx = Your personal tax rate

- N = The life of the mortgage in years

- n = The specific year for which the value is calculated

- pmtₙ = The mortgage payment for the year ‘n’

- Iₙ = total interest portion of payment in dollars, for the year ‘n’

- r = the (discount rate)* on the loan. (Or the APR)

- B = the payoff balance for the year N

*What is a discount rate?

It’s just another form of the interest rate on any form of credit! The discount rate is used for estimating the present value of a credit, whereas the interest rate is somewhat dealing with an amount in the future.

If an amount is having an interest rate of 10% that amounts to $110 in the 2nd year, then what was the original amount borrowed?

It’s $100.

It is called discount rate, because we are subtracting the interest from the future credit amount to find the present value! (i.e., $110 - $10 = $100)

In the above formula, consider your discount rate as your current interest rate!

As usual, this discount rate is the APR on your loan, and it will fluctuate for an ARM, while it will remain constant for FRM.

The above formula will yield the same result for the present value of the loan each year, in FRM. But the present value will change each year on an ARM, based on its different APRs.

Importance of calculating Present Value (PV) of mortgage especially if on ARM:

Usually, you take out an ARM if your plans are to move frequently from one home to another. If you want a lifetime asset, then ARM is probably not right for you. The huge changing loan terms on an ARM can turn out to be hectic!

So, by calculating the present value, you can understand when is the right time to sell your property. A peaking EMI and increased interest rate mean the property price is also high!

So, after doing the right calculations using the formulae, you can earn a huge profit if you make the correct decisions!

How to calculate the amortization for Adjustable Rate Mortgage:

As ARM changes its interest rate frequently, it becomes difficult to figure out the amortization spread out!

So, it’s better you take help of an ARM calculator to predict your payments and track the interest rates or loan terms.

For more details on understanding what’s better for you, an ARM or an FRM, click here.

Other things to understand in ARM and FRM mortgages:

The interest cap:

As the name goes, an interest cap is a maximum limit an interest rate can touch!

In case of home loans, especially ARM type home loans, the break down of interest cap results into 3 unique form of limits. One is the initial adjustment cap, second is the periodic reset cap, and the third is the lifetime cap.

The initial adjustment cap is the maximum limit up to which the variable interest rate on an ARM can reach, once the fixed rate period of the loan is over.

The periodic reset cap is up to which the interest rate can rise every time the rate adjusts on an ARM after the one-time initial reset.

The lifetime cap is the maximum limit an interest rate can increase throughout the loan term! So, if the lifetime cap is 10%, no matter how much the index increases, you will still pay 10% as the interest rate on your loan!

The discount points:

Not to be confused with the discount rate as explained earlier in this post. Discount points are a part of your overall loan amount that you can buy upfront to reduce payment stress later on!

One discount point is equal to one percent of your adjusted loan amount. So on a $100,000 loan, buying one point means you are paying $1000 upfront.

Obviously, there are many factors to understand while buying these points. Have a talk with your lender and see how much profit you can make by buying discount points.

Hope this article was definitely of some help. Understand all the points explained in this article, calculate and decide which loan type to choose, and where you will profit the most.

Remember, a home is an investment and every single penny you pay for your loan is used to build equity, which is an asset!