Why is it difficult to get hold of small mortgages?

People have many questions related to mortgage.

The most common ones are:

- How much down payment for what amount of loan.

- What happens if they can’t repay back their mortgage loan.

- How joint mortgage works.

- And why is it difficult to get hold of a small mortgage.

Our concern in this post will be to answer the last question, what makes it so difficult to take out small amount mortgage loans.

To answer this and understand this we should know a few things first.

This mortgage is a very difficult situation. It’s a secured loan, that has property involved.

This property, till it gets transferred to your name when you own it outright, is in a very floating situation.

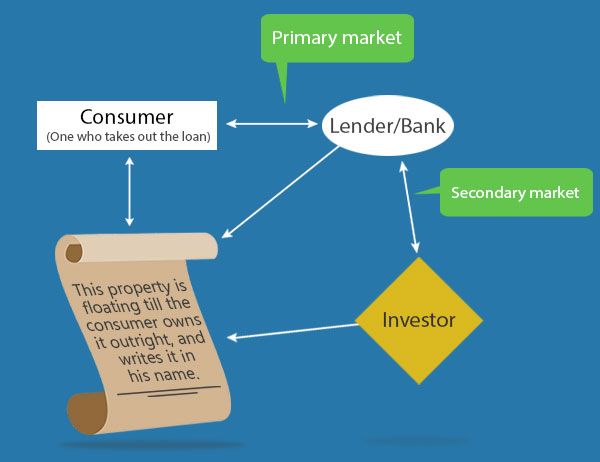

Before clearing your mortgage loan, this property is a component of two unique markets as described by Economics.

One is the primary market, and the other is the secondary market.

Please follow the diagram below.

You are the primary market. You purchase items and the seller benefits from it. The same thing happens with the mortgage. In the primary market, the loan is handled between you and the lender.

But the lender or the institution, from where you borrow the money, should need capital itself to fund such loans.

And who is funding such big amounts to the lenders? Obviously the investors.

These investors are the main source from where such big amounts originate.

So, if you default on the mortgage loan, you are answerable to the lender, because, behind the curtains, the lender is himself answerable to the investors.

Hence your inability to pay back the loan will hamper the investor, and anyone that falls in between, including the lender!

Now Don’t you think these banks and organizations have some economic interest in these loans?

The interest you pay and many other small things will be their profit.

Again these investors will pull out money from these lenders as they also have the same interest!

Ultimately it’s a long chain of profit involved with one single loan that you are taking out!

Why are small mortgages counted as unimportant by lenders?

One thing should have got pretty clear to you that the more is the amount, the more is the profit!

That’s because with bigger loans, you have to pay more in interests.

Now when the amount is low, the interest amount also gets lowered. Hence the lenders or the organizations consider these type of loans to be non-profitable.

Again there works this psychology in consumerism that first preference and importance is given to a case where more money is involved.

Also when you sign a mortgage loan, there’s something called the origination fees. This fee covers court expenses and other cost of paperwork. Usually, the lenders compensate such costs from the loan amount.

But with smaller mortgages, there’s little scope for the banks to recover the money spent in such paperwork and originating fees.

An example should serve as a good explanation why banks refuse to offer small mortgages.

Say mortgage 1 is $200,000 and mortgage 2 is $50,000.

Let’s assume that the interest charge for both of the mortgages is 10%. Then at one glance, anyone can see that there’s more profit in mortgage 1 for the lender.

Also, there are huge chances that the 2nd mortgage won’t have a longer repayment plan, while on the other hand, mortgage 1 has a possibility of hanging around for a longer period and will bring in more profit for the lender.

That’s all I had to say about small mortgages. The main reason behind the difficulty to get one is that small mortgages don’t have a good profit.

From where you can get small mortgages

If you can’t find any lender who’s ready to offer you a small mortgage, then you can try taking out a personal loan, but the interest rates will be high.

Credit unions and other small financial firms can also come to your aid. Moreover, there are other online lenders who have started to give out small amount loans and mortgages.

But as an endnote, all I can say is that you should not expect low-interest rates on these kind of small mortgage loans!